China’s real estate sector will need to return to stability, after muddling through the past two years of its worst debt crisis, before global fund managers can regain their confidence in high-yield bonds in the nation and across Asia, according to Pimco.

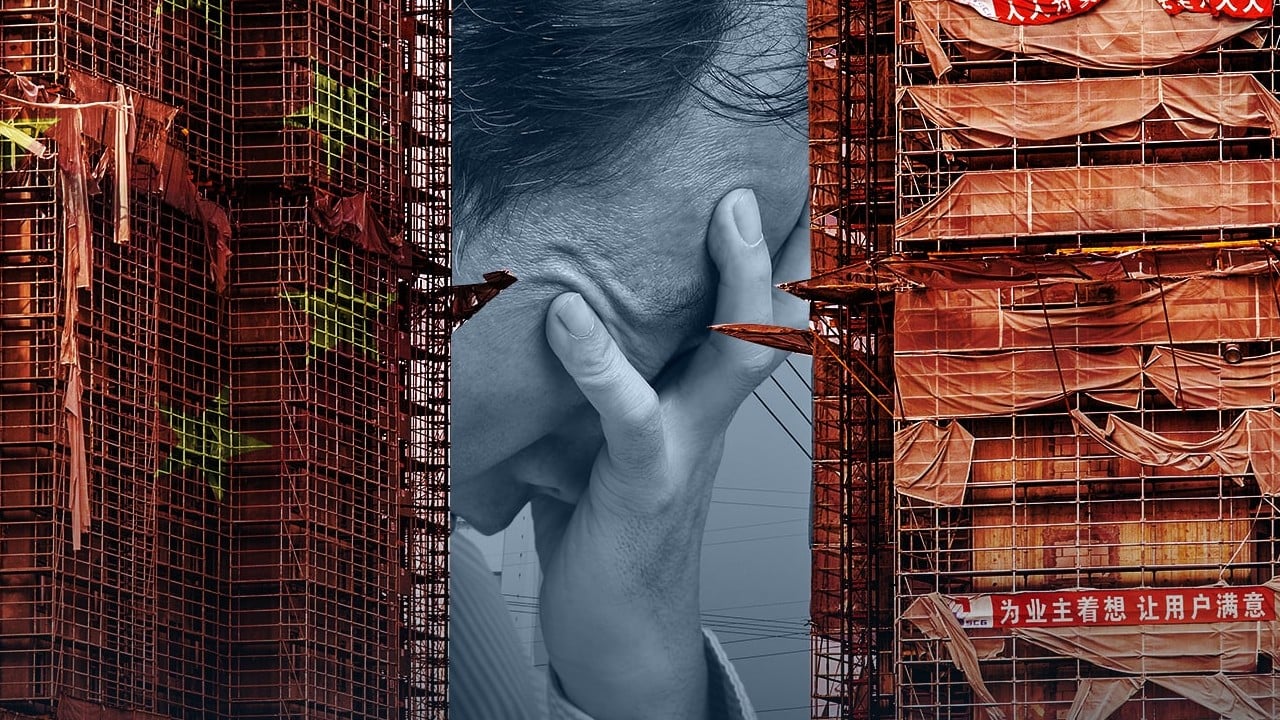

Investors are still nursing losses from a crash among Chinese developers, who contributed to the bulk of the US$200 billion bond defaults since Beijing announced its “three red lines” policy in August 2020. The move to shut funding access to weak borrowers coincided with Covid-19 outbreaks, driving the credit market into an unprecedented slump.

China Evergrande’s collapse in 2024, with some US$20 billion of unpaid dollar-denominated bonds, is emblematic of a lot of failures caused by excessive borrowings and building during the boom years. Scores of peers are still struggling to reorganise their debts and are in and out of court to repay creditors.

“We are very focused on the property sector as a leading indicator of China credit,” said Christian Stracke, president and global head of credit research of the California-based fund manager. “You won’t see a lot of interest in China offshore credit until there’s a stabilisation in the property market.”

Pimco, founded in 1971, managed about US$1.95 trillion of assets at the end of 2024. It was acquired by German financial services group Allianz SE in 2000. The US$46.3 billion Pimco Total Return Fund is the world’s largest actively managed bond fund.

China’s junk-rated developers were the most prolific debt issuers in Asia over the past two decades, offering juicy yields to entice global fund managers. They commanded more than 50 per cent weight in JPMorgan Chase’s Asian credit benchmark in 2020, before falling to less than 30 per cent at the end of last year, according to Nikko Asset Management.