Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

The UK and the US are close to agreeing a trade pact that would cushion the impact of Donald Trump’s “liberation day” tariffs by granting lower-tariff quotas for British car and steel exports, according to officials in London and Washington.

The deal — set to be signed this week — is due to include quotas that spare some UK exports from the full brunt of the additional 25 per cent tariffs that Trump levied on steel and car imports in February and March.

UK trade negotiators returned to Washington this week for the final stages of negotiations, which one senior British official said were continuing “at speed”, while cautioning that disagreements remained over pharmaceuticals.

As well as offering quotas for UK exports, Britain is also hoping to secure reductions in the sector specific 25 per cent tariffs that Trump has levied on cars and steel.

The UK’s “offers” include concessions to Washington on Britain’s digital services tax levied on international technology companies, cuts on tariffs imposed on US car exports, and a reduction of tariffs on American agricultural products.

However, the UK government has said it will not accept US food production standards, such as chlorine-washed chicken and hormone-treated beef, which would make it impossible to conclude a so-called veterinary agreement with the EU, a key plank of Britain’s impending “reset” with the bloc.

The expected UK-US deal is one of 17 agreements that the Trump administration has been aiming to sign with its major trading partners as it rows back on the sweeping tariffs imposed on countries around the world on April 2.

US Treasury secretary Scott Bessent told a congressional hearing on Tuesday that some of those deals could be announced “perhaps as early as this week”, adding that several countries had made “good offers”, without providing details.

Trump administration officials are in talks with multiple countries, including Canada, Mexico, Japan, Vietnam and India, as well as the EU.

Some foreign officials have privately expressed frustration that the administration has been unclear about how much tariff relief it will offer to trading partners.

If successful, the US-UK deal would follow a full-blown free trade agreement between Britain and India, which was announced on Tuesday.

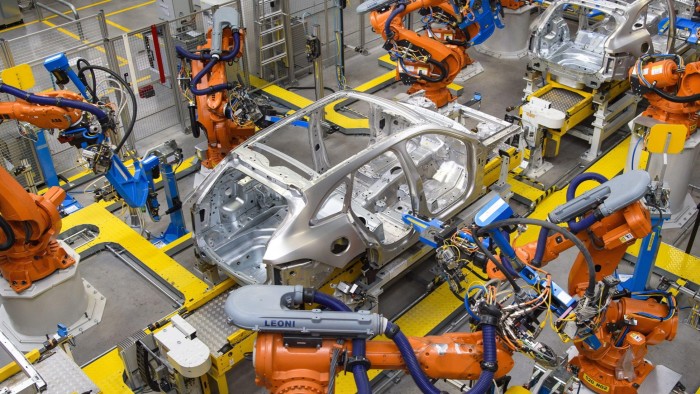

UK Prime Minister Sir Keir Starmer is under growing pressure to deliver a deal with the US after the British car and steel industries warned of potentially “devastating” effects on their sectors from Trump’s tariffs.

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, a trade body, has warned the new US tariffs were having a “severe, significant and immediate” impact at the top end of the sector.

Luxury marques such as Bentley, Jaguar Land Rover and Aston Martin depend heavily on exports to the US.

The US is the UK’s second-largest export market for carmakers after the EU, with more than 100,000 vehicles shipped last year, worth more than £7.5bn, according to the SMMT.

One senior car industry executive welcomed the news of potential lower-tariff quotas for UK vehicle exports, but warned that the key goal must be reducing the 25 per cent tariff rate.

“Quotas are complex to operate and inherently limiting to trade,” the executive added. “The most important thing is cutting the 25 per cent tariff, because above about 10 per cent, it’s just not sustainable.”

The UK was previously allowed to export up to 500,000 tonnes of steel a year to the US tariff-free under an agreement struck with the then president Joe Biden.

That deal was ripped up by Trump this year as he moved to reimpose tariffs of 25 per cent on all steel and aluminium imports to the US.

UK Steel, a trade association, has warned that Trump’s tariffs will stifle exports for an industry that is already under pressure from a global glut of the metal.

The US accounted for about 165,000 tonnes of British steel exports in 2023 — worth close to £400mn, and about 8 per cent of the total by value. UK exports to the US have nearly halved since 2017 when Trump imposed tariffs during his first term.

Two people with knowledge of the negotiations said the deal was being held up by disagreements over the pharmaceutical sector.

Last month the Trump administration launched national security probes into pharmaceuticals and microchips that could pave the way for tariffs on drugs — a UK export to the US worth £6.6bn in 2024.

Britain is seeking to avoid the worst of any future tariff impacts, according to UK officials, who described the quotas on offer from the US as “generous”.

A second UK official was more cautious, describing the expected deal as “limited”.