Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

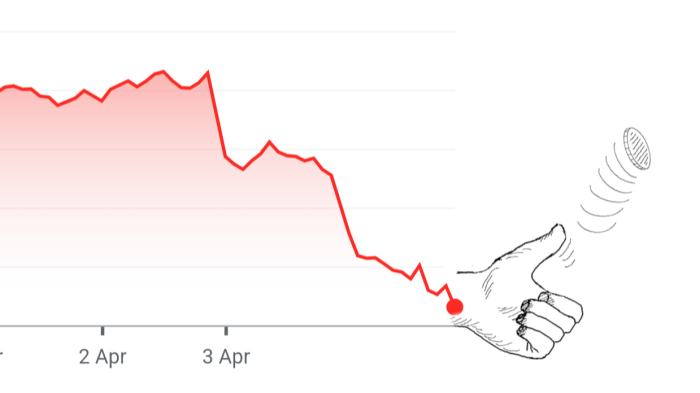

Within an otherwise anodyne note from Goldman Sachs assigning a 45-per-cent chance to a recession, readers can find the following paragraph (with our emphasis):

If most of the April 9 tariffs do take effect, then the effective tariff rate will rise by an estimated 20pp once those increases and likely sectoral tariffs take effect, even allowing for some country-specific agreements at a later date. If so, we expect to change our forecast to a recession.

Doesn’t get much simpler than that!

The funny thing is, GS’s house view is still a ~15-percentage-point increase in tariffs on Wednesday, not the ~20-percentage-point one that was announced.

And even then, the bank sees greater recession risk than there was one week ago.

In other words, even if there is a rollback, it’ll be harder to shake the decline in confidence, and the very real fact that the US has now pissed off a ton of its major trading partners.

The bank puts it more mildly, citing a greater “sensitivity of financial conditions to incremental tariffs”, including the 34-per-cent retaliatory tariffs that China imposed on the US late last week.

It also cited the ongoing “sharp tightening in financial conditions” (ie stocks sold off), along with “foreign consumer boycotts, and a continued spike in policy uncertainty that is likely to depress capital spending by more than we had previously assumed.”

They cite the decline in travel and warn about consumer boycotts, which all seem very possible:

It also seems likely that the US’s habit of detaining foreign travelers for no apparent reason has contributed to the drop in tourism as well. Not to mention disappearing non-citizens for having tattoos, or for simply exercising their First Amendment rights.

Anyway, if there’s no recession and the tariffs are rolled back to just a 15-percentage-point increase, GS still expects three “insurance cuts” from the Fed this year.

If the tariffs do go into place on April 9, the economists at GS expect the Fed to cut around 2 percentage points over the next year. So cheaper mortgages, but also a recession . . . Quite the trade-off!