Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

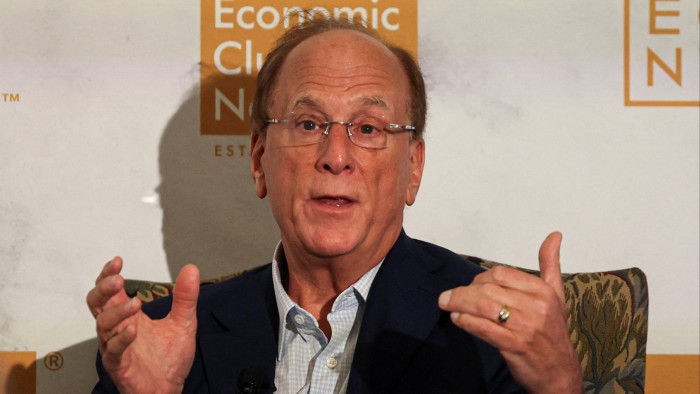

Larry Fink said the US economy was “weakening as we speak”, warning the market ructions triggered by Donald Trump’s tariffs were rippling across corporate America.

The head of BlackRock, the world’s biggest asset manager, told a gathering of chief executives and investors in New York that there was “a real downturn” developing in several sectors and that “more and more people were pausing and slowing down consumption”.

“When you see a 20 per cent market decline in three days obviously it has significant impacts and the ripple effects of the potential of tariffs is going to be long-standing,” Fink said. “The market is impacting Main Street.”

His comments come as investors grapple with a sell-off that has sheared trillions of dollars off of global equity valuations. Wall Street’s S&P 500 share index shed 10.5 per cent last Thursday and Friday alone, and swung violently at the start of this week as traders assessed the president’s plans to hit trading partners with steep levies.

The aggressive market pullback — the S&P 500 has fallen 17.3 per cent from its February high — has sparked a wave of margin calls on hedge funds, as traders stump up money or face being stopped out of their positions.

“Markets are down 20 per cent, some stocks are down 30, 40 per cent from their high water marks from January,” he said. “But in the long run this is more of a buying opportunity than a selling opportunity. That doesn’t mean we can’t fall another 20 per cent from here too.”

Fink’s comments at the Economic Club of New York prompted audible gasps from the audience. Many financiers have watched as shares of their investment groups have slumped since Trump’s ‘liberation day’ speech, as investors fret over a looming recession, lower profitability and the potential for corporate defaults. BlackRock’s shares have fallen 25 per cent from their all-time high in January.

Fink said he was troubled that the US was destabilising markets globally and that he saw “zero chance” the Federal Reserve would cut interest rates as investors were currently pricing, given the inflationary pressures developing.

Recommended

“I’m concerned about inflation if all the proposed tariffs truly go into place,” he said.

Fink also declined to say if he believed in a so-called ‘Trump put’, which would entail the president reversing tariffs if markets continued to sink. “I don’t know how to value that.”