Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Six months ago, the chipmaker Nvidia epitomised what investors liked about the American economy: it had sky-high profits, impressive innovation, and a charismatic — leather jacket-clad — founder, Jensen Huang.

Now, however, the company has inadvertently become a symbol of the business nightmares being unleashed by US President Donald Trump.

On Wednesday, Nvidia warned of a looming $5.5bn earnings hit from new US export restrictions on the sales of its chips to China.

Huang duly dashed to China, in a bid to salvage his deals. But Congress has unleashed a probe. So — unsurprisingly — Nvidia’s stock price has tumbled, along with other tech companies, as investors digest an unpleasant truth: Nvidia’s woes are just one tiny (highly visible) sign of a far wider wave of impending tech disruption from Trump’s trade wars.

There are at least three big lessons here. The first is that our modern political economy is haunted by a cultural dissonance. In our everyday lives we tend to act and think as if the digital platforms on which we depend exist in a disembodied, borderless, sphere.

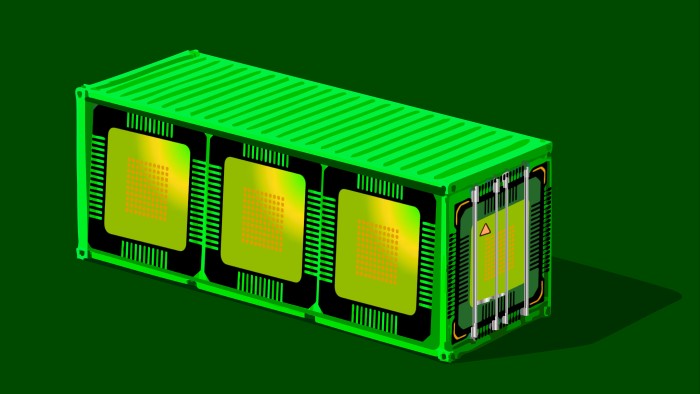

In fact, cyber space relies on physical infrastructure we tend to ignore — and the “most complicated supply chains [ever seen] in human history,” as Chris Miller, a Tufts professor, told a military and security conference at Vanderbilt University last week.

Those supply chains cross so many borders that “no one [country] is self sufficient — not even close,” Miller added, noting that while Japan dominates the wafer business (with a 56 per cent market share), the US has a 96 per cent share in electronic design automation software and Taiwan controls more than 95 per cent of advanced chipmaking. Meanwhile, China processes more than 90 per cent of many critical minerals and magnets needed to make digital goods.

The second lesson is that the White House seems ill-prepared for the consequences of disruptions to this complex supply chain. Consider, say, the issue of critical minerals.

This week Beijing imposed export controls over seven such minerals, after Trump imposed 145 per cent tariffs on China. That was no surprise, since 15 years ago China imposed similar curbs on Japan amid a fight.

Indeed, the 2010 move sparked such shock in Japan that its companies and government agencies subsequently created massive stockpiles of these minerals and developed some alternative sources, cutting their dependency on China from 90 per cent to 58 per cent.

But American entities apparently did not follow suit: at Vanderbilt I was told that American companies have (at best) a few months of stockpiles. Even the Pentagon seems ill-prepared. And while the White House is now seeking alternative sources — from the seabed or places such as Ukraine — that will probably take a few years to materialise, as the Centre for Strategic International Studies warned this week. That means America will “be on the back foot for the foreseeable future”, the CSIS adds.

Of course, Trump’s advisers insist this challenge is a temporary one, since America will eventually create a homegrown tech supply chain. That is the argument being advanced by Trump acolytes such as Peter Navarro, Bob Lighthizer and Stephen Miran, and writers such as Ian Fletcher and the three-generational trio of Jesse, Howard and Raymond Richman.

Indeed, if you want to understand the impulse behind the country-specific tariffs recently announced by Trump, it is worth looking at the Richmans’ book Balanced Trade, and a subsequent 2011 essay. “Trump’s formula for calculating specific country tariff rates is remarkably similar to our proposal[s],” says Jesse Richman, who cites figures such as Warren Buffett and John Maynard Keynes as the intellectual forefathers of this tariff philosophy.

Maybe so. But even if you embrace the theories driving such tariffs — which most modern pundits, including myself, do not — it is profoundly foolish to impose them without careful preparations. Starting a trade war with China without stockpiling critical minerals is a particularly obvious and stupid mistake.

So might this force Trump to retreat? Perhaps. Some of Trump’s advisers are ideologues but the president himself is (in) famously transactional.

That in itself simply highlights the third key lesson here: the White House seems to have badly underestimated China’s leverage in a trade war. After all, as the CSIS notes, “China [has been] preparing with a wartime mindset” for a conflict for a long time. However, “the United States continues to operate under peacetime conditions”, at least in the corporate world.

This is now changing, fast. And that means investors should brace for more tech supply shocks. Nvidia is just the leading edge in a potential storm.

gillian.tett@ft.com