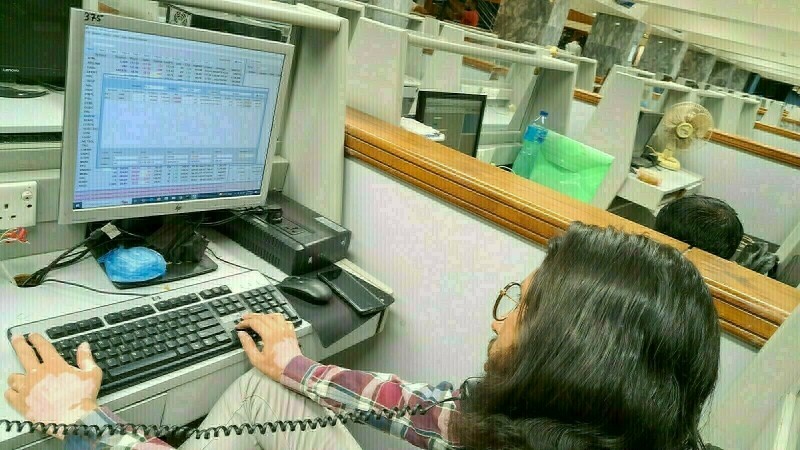

The Pakistan Stock Exchange (PSX) witnessed an upward swing on Tuesday as investors rejoiced over the central bank’s 1% policy rate cut, with the benchmark KSE-100 Index gaining nearly 800 points during the opening hours of trading.

At 10:15am, the benchmark index was at 114,869.36, an increase of 767.13 points or 0.67%.

Buying was observed in key sectors including automobile assemblers, cement, commercial banks, oil and gas exploration companies, OMCs, power generation and refinery. Index-heavy stocks including HUBCO, NRL, PSO, MARI, OGDC, PPL, POL, MCB, UBL and NBP traded in the green.

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) cut the policy rate by 100 basis points (bps) to 11% on Monday.

“This cut is higher than market expectations,” said Mohammed Sohail, CEO of Topline Securities. Market experts had earlier anticipated a 50bps cut.

On Monday, the PSX benchmark KSE-100 Index closed flat at 114,102.24, after recovering from the over 1,000-point loss it had incurred during trading.

Meanwhile, global stocks held tight ranges on Tuesday, and the dollar clawed back some of its recent losses against Asian counterparts as investors revived concerns about US tariffs and their impact on economic growth.

Those worries, coupled with pledges from key oil producers to boost supply, also kept crude prices languishing near four-year lows.

The focus in Asia has shifted to currencies following the Taiwan dollar’s surge in recent sessions, which has stoked speculation that a revaluation of regional foreign exchange was on the cards to win U.S. trade concessions.

Its rally suggested a big unwinding is underway and shines a light on one economy among many where years of big trade surpluses have built up large long dollar positions at exporters and insurers that are now under question and on edge.

The heat turned to Hong Kong on Tuesday, where the de facto central bank bought $7.8 billion to stop the local currency from strengthening and breaking its peg to the greenback.

In stocks, MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.2% lower, with Japan closed for a holiday. Taiwan stocks slipped 0.3%.

Chinese markets returned from a holiday with the blue-chip index opening slightly higher. Hong Kong’s Hang Seng was down 0.2%.

Investor attention has been on the possibility of easing trade tensions between the US and China after Beijing last week said it was evaluating an offer from Washington to hold talks over tariffs.

But with few details, uncertainty has reigned, with investors left trying to make sense of headlines coming out of the White House.

This is an intra-day update