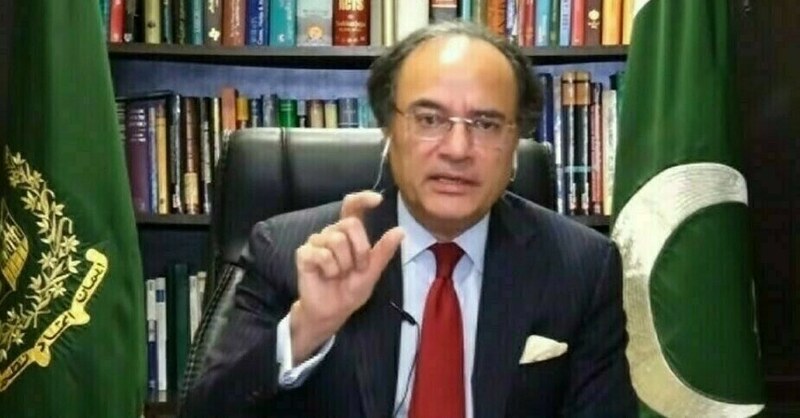

KARACHI: Federal Minister for Finance and Revenue, Muhammad Aurangzeb, Friday said Pakistan is adopting the Malaysian Green Finance Model to enhance its debt management strategy and address climate change financing needs.

He made these remarks while addressing a gong ceremony organized by the Pakistan Stock Exchange (PSX) via video link from Karachi on Friday, marking the launch of the country’s first-ever sovereign domestic green Sukuk. The finance minister highlighted that Pakistan stands to gain valuable insights from the Malaysian model and expressed confidence that the country can effectively move in that direction.

He further told the participants that in overall debt profile of Pakistan, Sukuks have the share of around 14 percent. “We are in the process of restructuring and reorganizing our debt management office in line with the global best practices and adopting modern lines” he added. He further said that “What we will do is to continue to engage the investors to get their feedback on this and you will listen soon on these lines.”

Talking on the Green Sukuk, Finance Minister said that Climate Change is the existential threat for Pakistan and the government is stressing on the need of financing for it along with acquiring IMF’s $1.3 Billion Climate Resilience fund and with other concrete reform measures. He termed the launch of Green Sukuk Bond as a great achievement of Pakistan.

Aurangzeb also mentioned his recent meetings in United States and UK and said that the messages coming from Multilateral, bilateral partners and investors is that they are surprised with the speed of recovery of country’s economy showed in a short span of time. He further told the audience that structural reforms are under way in various sector of the economy including energy, SOEs, Privatization, and Public Finance in terms of right sizing, pension reforms and others which will also be carried actively in next Fiscal year also.

Finance Minister stated that the upcoming budget will reflect the strategic direction of Pakistan’s economy that will be very much in line with the home grown economic agenda.

The Finance Minister also congratulated PSX for hitting record all time high market index on Thursday that according to him show strong confidence of the investors in terms of comprehensive successes, however, he believed that best is yet to come both for PSX (Pakistan Stock Exchange) and Pakistan.

The Chairperson of the Pakistan Stock Exchange Dr. Shamshad Akhtar revealed the country’s plans to issue both Green Sukuks and Green Bonds, aiming to tap into the US$ 4 trillion Islamic finance and US$ 2.5 trillion green bond markets. With climate adaptation needs projected to reach US$ 348 billion by 2030, exceeding traditional financing capacity, Green Sukuks are seen as a crucial gateway to addressing this gap.

She added that Pakistan has significant potential to become a regional leader in Shariah-compliant green finances. Despite the current energy mix being 60% fossil fuels, Green Sukuks can facilitate a transition to renewables. The country boasts over 40,000 megawatt (MW) of solar and 50,000 MW of wind potential, presenting key opportunities for green investment. Additionally, Green Sukuks can finance waste-to-energy projects, further diversifying Pakistan’s energy landscape, she added.

On the occasion, Advisor to the Finance Minister, Khurram Schehzad, also highlighted two major national challenges: climate change and population growth. He also shared positive development in three key indicators of economic improvement, including a rise in tax-to-GDP ratio from 9.5% to 10.6% and that is expected to reach 11% by FY26, while reduction in debt-to-GDP ratio from 74% to 65%, and an increase in government revenues.

Officials said that issuing of Green Sukuk is a landmark move towards sustainable development and environmental stewardship, which Pakistan Stock Exchange (PSX) has successfully launched under the Sustainable Investment Sukuk Framework. These Shariah-compliant Sukuk aim to finance key green initiatives, including renewable energy, pollution control and climate adaptation projects.

On the other hand, Investors can also earn competitive returns while contributing to a greener Pakistan, making a positive impact on both the environment and society.

Dr Shamshad Akhtar highlighted the significance of Pakistan’s inaugural domestic sovereign Green Sukuk, marking a new era in financial innovation rooted in sustainability, inclusion, and accountability. This debut issuance demonstrates Pakistan’s commitment to a greener economy, unlocking investments in renewable energy, green transport, and climate-resilient infrastructure.

Meezan Bank’s President & CEO, Irfan Siddiqui, emphasized the role of Islamic finance in sustainable development, stating that the Green Sukuk combines Islamic finance with climate-resilient investments, offering Shariah-compliant avenues for investors to contribute to Pakistan’s green transition.

The Sukuk was remarkably oversubscribed by 5.4 times, reflecting strong investor confidence. PSX’s MD/CEO, Mr. Farrukh H. Sabzwari, noted that this milestone showcases the growing integration of Environmental, Social, and Governance (ESG) principles in Pakistan’s capital market, with more sustainable Sukuk issuances expected in the coming months.

The event was attended by key stakeholders, including Mohsin Mushtaq Chandna, Director General (Debt); Muhammad Ali Malik, Executive Director of the State Bank of Pakistan; Nassir Salim, President of HBL; Badiuddin Akber, CEO of CDC; Naveed Qazi, CEO of NCCPL; and prominent members of the financial sector and capital market fraternity.

Copyright Business Recorder, 2025