New World Development is seeking to divest real estate projects in mainland China after pulling off an US$11 billion refinancing deal in June, according to people familiar with the matter.

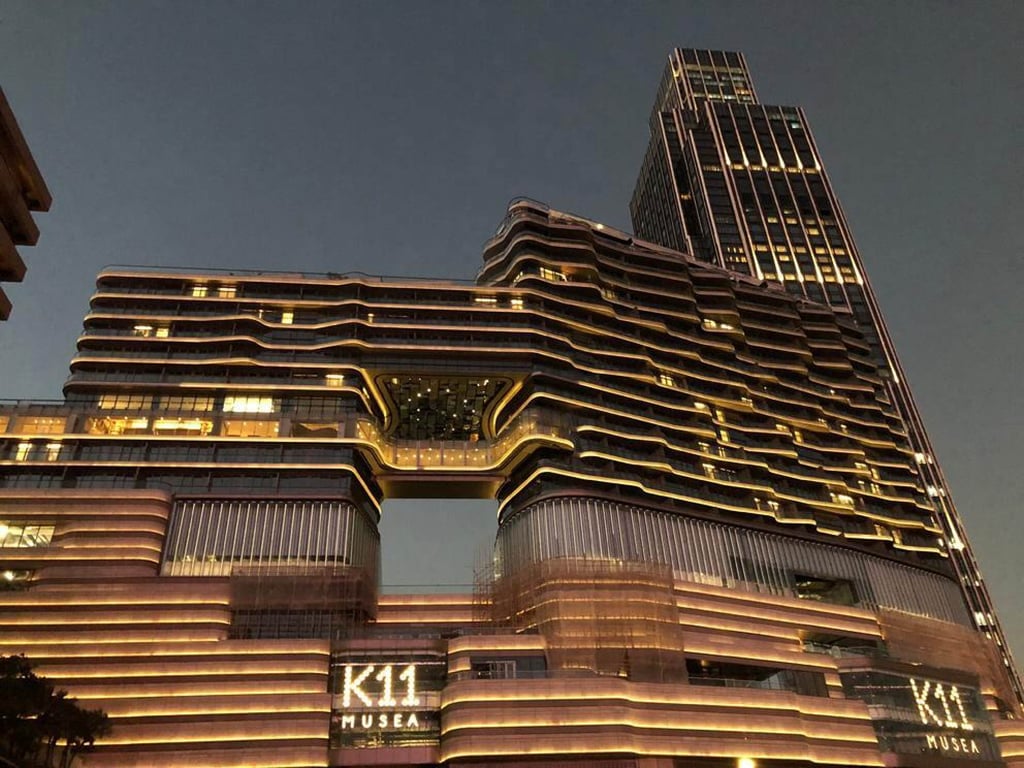

The Hong Kong developer was planning to sell property assets in China piecemeal, including landmarks like its K11 buildings in Hangzhou, Shenzhen and Shanghai, the people said, asking not to be named because the matter is private.

New World was expediting asset sales as part of its agreement to secure its June loan refinancing agreement with banks, the people added. The company favours buyers such as investment funds or private firms that could make swift decisions and offer faster cash recovery, one of them said.

The developer remains in the spotlight as it continues to face liquidity stress and is seeking to raise as much as US$2 billion through a new loan that would be backed by its crown jewel asset, Victoria Dockside in Hong Kong.

The firm set a commitment deadline for July 11, Bloomberg previously reported. It is common for borrowers to extend such deadlines for various reasons in the syndicated loan market.