Asia-Pacific markets opened mixed Thursday after Wall Street continued to reach record highs over Fed-rate cut hopes and positive inflation data.

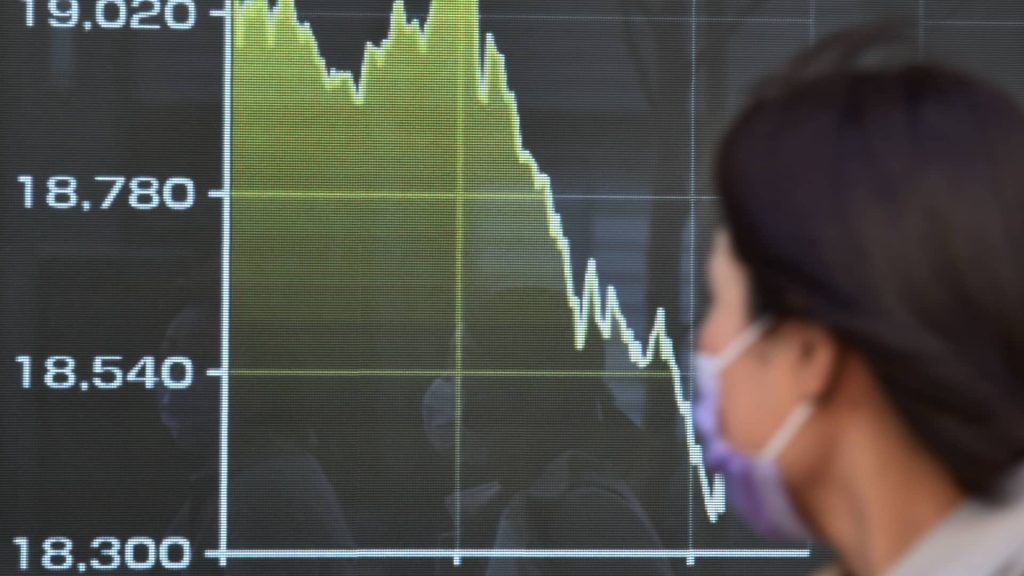

Japan’s benchmark Nikkei 225 rose 0.23% in early trade, while the Topix index retreated 0.18%.

South Korea’s Kospi advanced 0.67%, and the small-cap Kosdaq was up 0.2%.

Over in Australia, the ASX/S&P 200 declined 0.29%.

Meanwhile, Hong Kong’s Hang Seng Index was set to open lower with the futures contract at 25,994, compared with the index’s last close at 26,200.26.

U.S. equity futures were little changed in early Asian hours, as Wall Street awaited a key consumer inflation gauge for August due out Thursday morning stateside.

Overnight stateside, most of the key U.S. benchmarks rose to hit new record closing highs after the latest producer price index data showed that inflation was cooling.

The broad market S&P 500 finished up 0.3% at 6,532.04, a record close for the index. It had risen about 0.7% at its peak to 6,555.97, scoring a new all-time intraday high as well. The Nasdaq Composite edged up 0.03% to end at 21,886.06, likewise notching a closing high after hitting an all-time intraday high before its afternoon pullback. The Dow Jones Industrial Average lost 220.42 points, or 0.48%, to finish at 45,490.92, bogged down by a decline in Apple shares as the latest iPhone announcement failed to impress investors.

— CNBC’s Sean Conlon and Lisa Kailai Han contributed to this report.