A majority of Asia-Pacific institutional investors believe markets are due for a correction in 2026, citing a potential tech bubble, geopolitical tensions and recession as their primary worries, according to a survey report published on Tuesday by Natixis Investment Managers.

Global markets had been “remarkably resilient” in 2025 despite challenges such as tariffs, geopolitical conflicts and supply chain disruptions, according to Natixis. However, 74 per cent of institutional investors globally – including 80 per cent in the Asia-Pacific region – believed a correction was overdue.

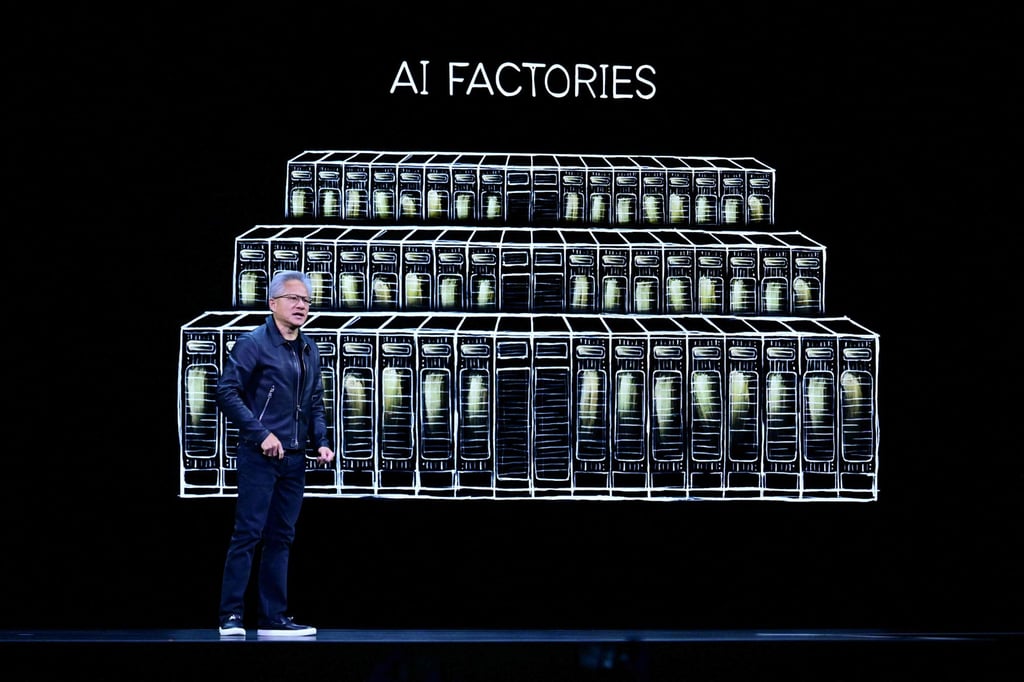

Among Asia-Pacific investors, 48 per cent cited the potential for a tech bubble as their top concern, followed by geopolitical shocks at 45 per cent and recession at 40 per cent. For global investors, geopolitical shocks ranked first, with 49 per cent expressing concern.

The sentiment suggested that “markets could run out of luck in the new year”, the asset-management firm said.

About 60 per cent of investors in the region planned to boost their allocations to equities within their home region to diversify away from the US.

“After a prolonged period of US market outperformance, international and non-US equities moved back into focus in 2025,” said Dora Seow, CEO of Natixis Investment Managers Singapore.