Cost of living correspondent

Getty Images

Getty ImagesThe Bank of England is expected to keep interest rates on hold when policymakers announce their latest decision on Thursday.

The Bank rate heavily influences the cost of borrowing for households, businesses and the government, as well as returns for savers.

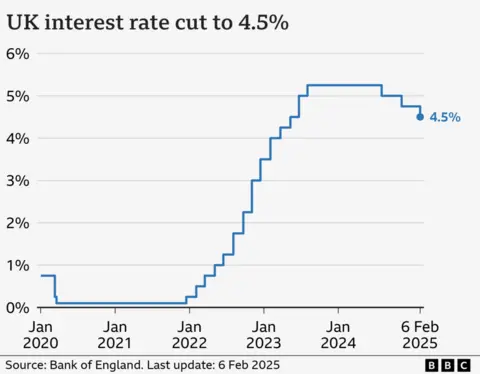

It was cut from 4.75% to 4.5% following the last meeting of the Bank’s Monetary Policy Committee (MPC) in February.

While no change is expected when the announcement comes at 12:00GMT, many analysts are forecasting two further cuts by the end of the year.

Widespread impact

The MPC has a membership of five women and four men, including economists and leading figures at the Bank of England. It is chaired by the Bank’s governor, Andrew Bailey. How these members vote will be closely watched by the markets.

The committee meets eight times a year, and its decisions have a widespread impact on everything from the cost of mortgages to businesses’ ability to invest.

Its primary objective is to use interest rates to ensure inflation – the annual rate of rising prices – hits the government’s target of 2%.

The latest calculations showed the inflation rate rose to 3% in January, one reason why commentators expect interest rates to remain on hold this time around.

Lowering rates could stimulate more spending by consumers and push inflation higher.

That could be a blow to some homeowners who would like to see interest rates and, in turn, mortgage rates continue to fall.

“Bank of England policymakers have been warning on inflation and lingering uncertainty, so further rate cutting relief for homeowners looks to be an unlikely outcome from this month’s meeting,” said Paul Heywood, chief data and analytics officer at credit agency Equifax UK.

Mortgage interest rates have been slowly edging down, primarily because the markets and loan providers expect further falls in the Bank rate as the year goes on.

The MPC has made three interest rate cuts since August 2024, bringing it down to its lowest level for 18 months. However, the Bank has also said it will take a “gradual and careful” approach to further reductions.

Lower rates could also mean lower borrowing costs for loans and credit cards, but also lower returns on savings.

Wider economic picture

Those decisions will be driven by the outlook for the UK economy.

Following the MPC meeting in February, the Bank halved its economic growth forecast for this year, although it upgraded its forecasts for 2026 and 2027.

It said the UK economy was now expected to grow by 0.75% in 2025, down from its previous estimate of 1.5%.

Meanwhile, it said it expected the rate of inflation to rise to 3.7% and take until the end of 2027 to fall back to its 2% target.

On top of these predictions come uncertainty over domestic and global economic policy.

Next week will see Chancellor Rachel Reeves deliver her Spring Statement, which is unlikely to include major policy announcements but will include the view of the official forecaster – the Office for Budget Responsibility – on the direction of the UK economy. It will also include some details of spending allowances for government departments.

The UK economy is widely seen to be underperforming and global factors, such as US trade tariffs, are having an indirect impact on the UK.