Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

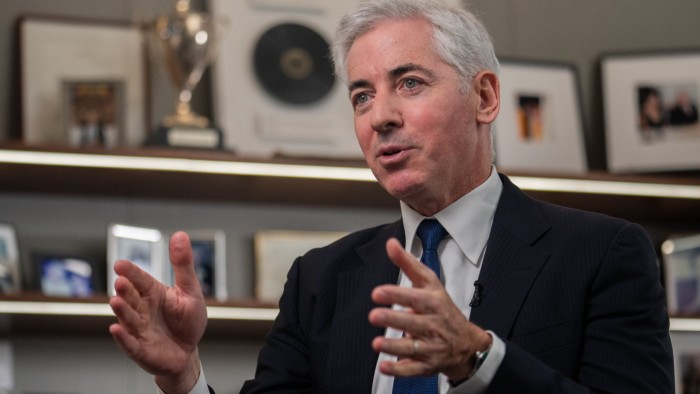

Shares in billionaire Bill Ackman’s main investment vehicle have fallen 15 per cent this year as Donald Trump’s trade war hits the portfolio of one of his most ardent Wall Street backers.

The drop in Pershing Square Holdings, Ackman’s London-listed investment trust, comes as the financier has turned sour on some of the US president’s policies in a major public reversal. The trust’s share price fell more than 3 per cent on Monday.

“If . . . on April ninth we launch economic nuclear war on every country in the world, business investment will grind to a halt, consumers will close their wallets and pocket books, and we will severely damage our reputation with the rest of the world that will take years and potentially decades to rehabilitate,” he said on X on Sunday.

Fewer than 100 days into Trump’s second term, the unravelling of the financial markets has pummelled many of Ackman’s biggest bets, leaving his investment trust nursing large losses.

The billionaire’s investment trust holdings in Nike, Mexican-style fast-food chain Chipotle, asset manager Brookfield and Alphabet have taken the biggest hits since the start of the year. They were all down more than 20 per cent by late afternoon in London trading on Monday.

Alphabet and Brookfield were two of Ackman’s biggest positions in the trust at the end of last year, worth almost $2bn and $1.8bn, respectively, according to the company’s annual report.

As of last Monday, Pershing Square’s underlying investments, also known as the vehicle’s net asset value, were down 1.2 per cent for the year, based on the firm’s public disclosures. It had reported no hedging positions entering last week’s market plunge.

But Ackman is not the only casualty of Trump’s trade war among prominent Wall Street investors.

Fellow billionaire hedge fund manager Dan Loeb, another critic of the tariffs on X, has seen shares in his publicly listed fund Third Point fall almost 10 per cent since the start of the year. The fund’s net asset value was down 1.4 per cent for the year as of last Wednesday before US equities markets plunged on Trump’s so-called liberation day tariff announcements.

Ackman also pleaded with the president to institute a 90-day “time out” to negotiate “unfair asymmetric tariff deals” on X on Sunday.

Later on the same day, he lashed out at US commerce secretary Howard Lutnick, who has said he is a strong supporter of the tariffs on live TV, alleging that he and his company Cantor Fitzgerald profit “when our economy implodes”.

On Monday he backtracked, stating it was “unfair” to criticise Lutnick. Ackman said on X that he was “sure [Lutnick] is doing the best he can for the country”, but suggested that Trump was “not an economist” and was relying on tariff calculations by his advisers that were made in error.

Ackman was a vigorous Trump supporter on the campaign trail and in his early presidency when he said the incoming administration would be one of the most “pro-business” in American history.

Recommended

As Trump was ascending in the polls last year, Ackman was working to raise a $25bn US-based investment fund, a precursor to taking his hedge fund Pershing Square Capital public.

But Ackman was forced to shelve those plans, leaving him to manage the about $16bn he manages mostly through his London-listed investment trust.

Not all parts of Ackman’s portfolio have taken a hit. His investments in government-backed mortgage sponsors Fannie Mae and Freddie Mac, which Ackman believes Trump’s administration will privatise and fuel their market value, were up 60 per cent and 32 per cent, respectively.

Pershing Square declined to comment.

Additional reporting by George Steer in New York.