Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

Companies are hunting for creative ways to cut the customs value of their imports to the US in an effort to blunt the financial impact of President Donald Trump’s punitive tariffs.

Advisers say there are methods to lower the reported value of imports by a fifth or more in some cases, but they come with risks and could complicate the intricate tax planning strategies that multinational companies have built up over decades.

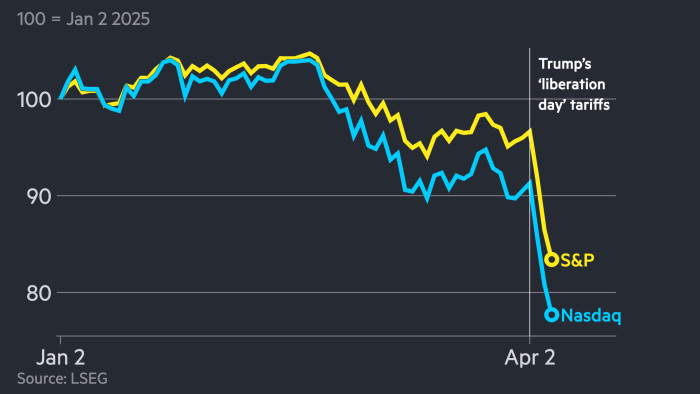

With Wednesday’s announcement of new tariffs on imports from almost every country and across most product categories, conversations about so-called valuation strategies have taken on new urgency, consultants say.

“Can you lower the base through various customs planning techniques, so a good that is otherwise sourced at $100 and paying a 25 per cent tariff, can you make that good $90 paying a 25 per cent tariff?” said Mark Ludwig, head of national trade advisory services at RSM, the largest US accounting firm outside the Big Four.

“Magnify that across your universe of goods and over time those moves can add up and make you more competitive.”

Two valuation strategies in particular have increased in popularity, consultants said, as Trump has targeted industries that typically had low or no tariffs. The first involves arranging contracts with suppliers so that an importer can legally report an earlier sale price, before mark-ups by intermediaries. The second involves splitting payments to suppliers into two amounts, only one of which would attract duties.

An example could be a spirits importer whose supplier not only sold them the drink, but also provided advertising and promotional help, said Mathew Mermigousis, BDO’s customs practice leader.

“Under customs rules, generally advertising and promotion is not a dutiable cost,” he said. “If you’re able to extract that and create a separate service payment for it, you lower the dutiable value to help mitigate the impact” of tariffs.

In a webinar for clients on Friday, EY pitched a more intricate version that involved splitting out a royalty for using the intellectual property underlying a product. The royalty should “preferably” be paid to a separate company from the product supplier, it advised.

Within multinationals, which move goods around in a network of global subsidiaries, such strategies can run counter to long-standing tax avoidance plans that typically involve paying high prices to foreign subsidiaries. Those payments are often designed to lower the profits made in the US and increase them in foreign jurisdictions where taxes are lower.

“Historically, many companies have done tax planning first and customs and duty planning second, or 100th,” said Kristin Bohl, a customs adviser at PwC.

The two disciplines can be at “loggerheads”, she said, given that lowering tariffs might increase your income tax bill.

Recommended

“If you pull one lever and trip up another, then you’re no better off than when you started. But the magnitude of the tariff impact has triggered companies to be more thoughtful about balancing between the two.”

Andrew Siciliano, trade and customs practice leader at KPMG, said he expected multinationals to examine the policies underlying their tax strategy — known as transfer pricing arrangements because they govern the prices charged between subsidiaries in different jurisdictions — and could find they have room to lower prices for US subsidiaries following the tariff rises.

But he cautioned that there are risks to valuation strategies, given they may be questioned by customs authorities.

“It’s complex and risky if not done right,” he said.