This article is an on-site version of our Swamp Notes newsletter. Premium subscribers can sign up here to get the newsletter delivered every Monday and Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

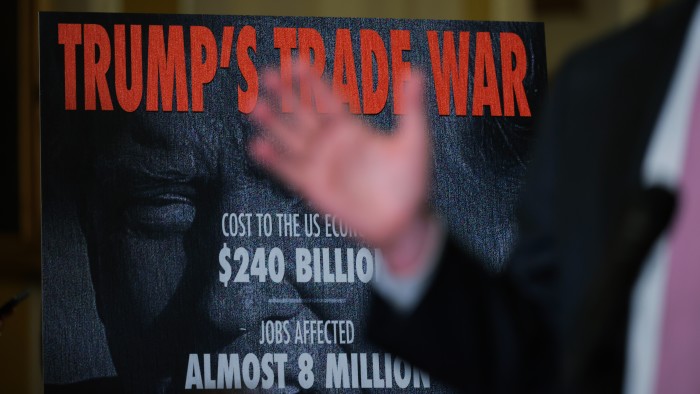

I’ve been in several conversations recently with senior Democrats and advisers who are considering how to play Trump’s disastrous tariff rollout politically. In many ways, this is low hanging fruit — the president inherited the best post-Covid recovery in the rich world, and is now pushing the economy towards recession. His ridiculous “buy” post on social media, which preceded the 90-day pause on additional tariffs, only confirms that we are now officially living in a banana republic. Policy is being made by one guy who is unhinged.

But putting that aside, many centrist Democrats are saying this is the moment for liberals to move completely away from the conventional economic wisdom of both the Trump and Biden administrations, which is that the global trading system must be rebalanced. To take that lesson from the past few days would be a mistake.

Trump’s tariff chaos was an unnecessary economic own-goal (I’ll have more on that in my column on Monday) that will have lasting consequences. But going back to the 1990s isn’t going to fix what’s broken globally.

Let’s do a quick history review. During Trump’s first term, then USTR Robert Lighthizer bravely raised the curtain on the imbalances between the US and China and forced everyone to stop pretending that China would get freer as it got richer. The US put very surgical and strategic tariffs on China, which didn’t cause inflation, mostly because China took the hit with a currency adjustment.

Biden then comes in, keeps the tariffs in place, but also rolls out a true industrial strategy, the highlight of which was the reinvigoration of the American semiconductor industry, which happened faster than anyone imagined possible. The fact that this didn’t get more good press is shocking, but what’s even more amazing is that Trump didn’t continue the strategy. Instead he’s actively talking about dismantling the Chips Act.

This isn’t how a president that really wants to reindustrialise the heartland acts. Now, to be fair, Biden’s industrial policy wasn’t perfect. He should have paid a bit more attention to the potential short-term hit from inflation, and didn’t do the clean energy transition perfectly. (It would have been great to create shared environmental and labour standards with Europe and avoid giving Brussels the sense that the US was trying to build its own EV industry at the expense of the EU.) But it was a great start, particularly given that the US hasn’t had major government market shaping since the New Deal.

Now, we have Trump 2.0, tariffs, and an economic paradigm shift with no rudder. Rather than building demand signals with allies, the president fights the world all at once. And despite his executive order to revitalise US shipbuilding that (finally) came down Wednesday, there’s no real industrial policy.

This, I believe, presents an opportunity for Democrats. Rather than saying let’s go back to the Clinton era, as the usual neoliberal suspects inside and outside the party seem to want to do (that’s just not a winning political message for working people), it’s a moment to focus on how and why this tariff strategy is potentially devastating for lower-income voters. First, it would raise inflation significantly because it’s everything, everywhere, at all once, and that always hits the poor hardest. Secondly, the places that would likely scale back jobs and investment in the short-term would be areas like Detroit, because complex machinery like cars have so many imported parts.

Rather, Democrats should use the next two years to really focus on a digestible, politically salient message around trade. Policy wise, I think that includes tariffs on China, which is the real problem in terms of mercantilist practices and security issues, but also a clear plan for how to support workers and industries at home. My fear right now is that despite market chaos, Trump’s plan, assuming we end up with some moderate deals around lowering tariffs globally, will seem pretty good to working people, and we will have to deal with yet another four years of Republicans’ unfunded tax cuts, undermining of relationships with allies, and attacks on democratic values.

Jonathan, you’ve just come over from the UK to the US as the FT’s US opinion editor. What’s your fresh-eyed view on my political advice to Democrats? And have we just had our own Liz Truss moment, or is that yet to come?

Recommended reading

Jonathan Derbyshire responds

Hi Rana. I certainly think this is Trump’s Liz Truss moment — which is to say that he learnt a painful lesson, as the former UK prime minister did with her 2022 “mini” Budget, about the power of the bond markets to discipline elected politicians.

I have lost count of the number of times since Trump announced the 90-day pause on “reciprocal” tariffs that I have heard people quote James Carville’s famous line about wanting to be reincarnated as the bond market because “you can intimidate everybody”, including, as it turns out, an unconstrained second-term would-be strongman apparently able to bend corporate America, the legal profession and the Ivy League to his will.

Carville might have been right about the power of the bond vigilantes, but, as you suggest, the Democrats should nonetheless be wary of harking back too much to the Clinton era. A few weeks ago, I met a former official in the Biden administration who told me Carville was right to advise the party to “roll over and play dead” — in other words, to stand back and allow the Trump administration to make mistakes and generally wear itself out. That both underestimates the zeal of this administration and overestimates the extent to which the normal rules of political gravity apply to this president, Wednesday’s lesson in the dangers of hubris notwithstanding.

It has become something of an article of faith for many Democrats that they lost November’s presidential election because Kamala Harris and her running mate Tim Walz had more to say about the threat Trump poses to American democracy than they did about the price of eggs. I was struck by something Barack Obama said last week, which many in his party would do well to consider: “I think people tend to think democracy, rule of law, independent judiciary, freedom of the press, that’s all abstract stuff because it’s not affecting the price of eggs. Well, you know what, it’s about to affect the price of eggs.”

Your feedback

And now a word from our Swampians . . .

In response to “Are we seeing the fall of Elon Musk?”:

“[Elon Musk] built his wealth from the ground up (yes, I know he didn’t found Tesla!) — giving him the same title of oligarch, as Russia/India/etc’s politically connected kleptocrats isn’t fair . . . They’re useless thieves — the worlds greatest nepo babies. Elon Musk, for all his faults, is not that.” — FT commenter Murcielago_Boy

In response to “Is Trump going into nosedive?”:

“I sense an ongoing struggle — both in your assessment and across the broader FT and mainstream media — to connect the dots in a way that fully makes sense of the current moment. That struggle, I believe, stems from an assumption that there is still some underlying rational logic driving recent political developments. What the US is grappling with, however, is the ascendance of ideology over facts. In the realm of ideology, facts no longer matter. Figures like Lutnick understand this well. Brazen lies and disinformation aren’t anomalies — they are means to an end, used to reinforce and legitimise a worldview. Repeat it so many times until it becomes the fact.” — FT commenter Third wise man

Your feedback

We’d love to hear from you. You can email the team on swampnotes@ft.com, contact Rana on rana.foroohar@ft.com and Jonathan on jonathan.derbyshire@ft.com. We may feature an excerpt of your response in the next newsletter

Recommended newsletters for you

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here