Affluent investors in Hong Kong have nearly tripled their allocation to gold amid economic and geopolitical uncertainties, according to an HSBC survey.

Individual investors in the city with US$100,000 to US$2 million in investible assets had allocated 11 per cent of their portfolios to gold and other precious metals, up from 4 per cent a year ago, according to the survey published on Thursday. On the mainland, wealthy investors had increased their gold holdings to 15 per cent compared with 7 per cent a year earlier.

The trend mirrors that of their global peers, with their share of investments in gold rising by 6 percentage points to 11 per cent over the past year.

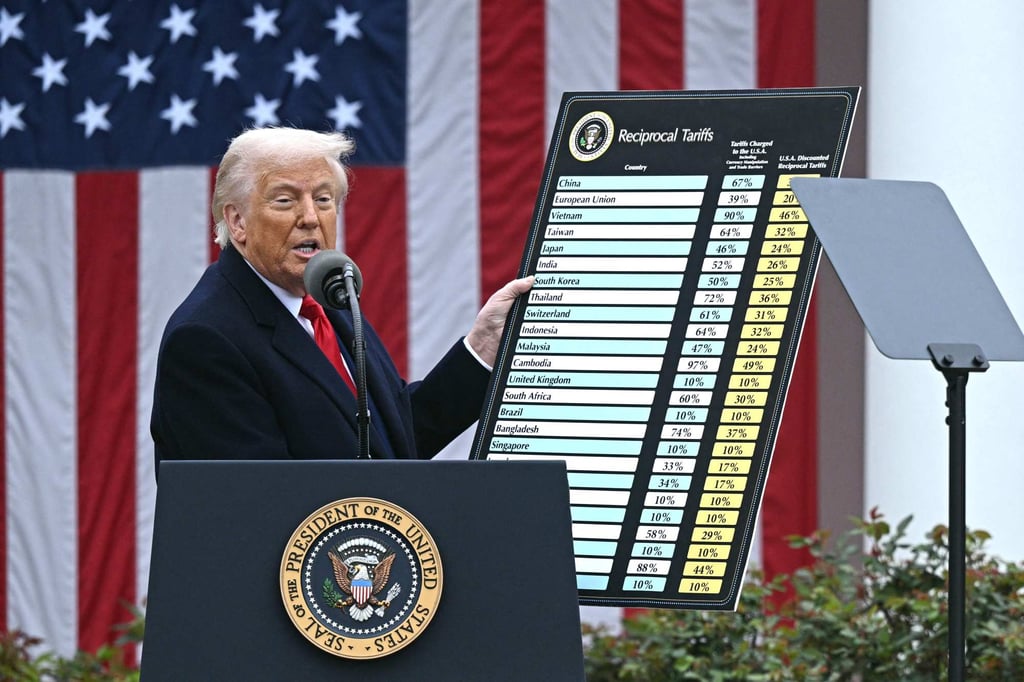

Gold was trading at US$3,356.61 per ounce on Thursday, up 28 per cent year to date. The precious metal hit an all-time high of US$3,500 in April. The rally followed sweeping tariffs imposed by US President Donald Trump against all major trading partners, which sent global markets tumbling and prompted a rush for haven assets.

In May, central banks around the world added a total of 20 tonnes to their gold reserves, according to the World Gold Council. The National Bank of Kazakhstan added seven tonnes, while the People’s Bank of China added three tonnes.