Getty Images

Getty ImagesThe UK government generally spends more than it raises in tax.

To fill this gap it borrows money, but that has to be paid back – with interest.

Why does the government borrow money?

The government gets most of its income from taxes. For example, workers pay income tax and national insurance, everyone pays VAT on certain goods, and companies pay tax on profits.

It could, in theory, cover all of its spending from taxes, and that sometimes happens.

But, if it can’t, the government covers the gap by raising taxes, cutting spending or borrowing.

Higher taxes mean people have less money to spend, so businesses make less profit, which can be bad for jobs and wages. Lower profits also mean companies pay less tax.

So, governments often decide to borrow to boost the economy. They also borrow to pay for big projects, like new railways and roads.

How does the government borrow money?

The government borrows money by selling financial products called bonds.

A bond is a promise to pay money in the future. Most require the borrower to make regular interest payments.

UK government bonds – known as “gilts” – are normally considered very safe, with little risk the money will not be repaid.

Gilts are mainly bought by financial institutions in the UK and abroad, such as pension funds, investment funds, banks and insurance companies.

The government sells short and long-term gilts to allow it to borrow money over different time periods, with varying interest rates.

How much is the UK government borrowing?

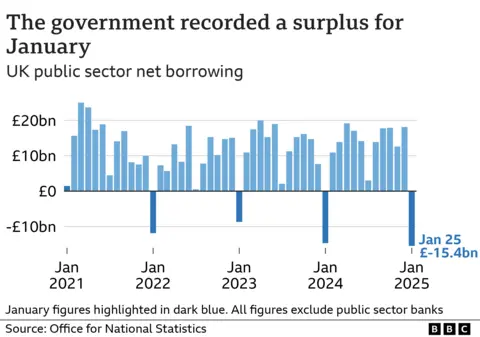

The amount the government borrows fluctuates from month to month.

For instance, it tends to borrow less in January, when many people pay a large chunk of their annual tax bill in one go.

So, it is more helpful to look across a whole year, or the year-to-date.

In the last full financial year, to March 2024, the government borrowed £125.1bn.

The most recent monthly figures from the Office for National Statistics (ONS) show that the government had a surplus of £15.4bn in January – the highest level for the month since records began more than three decades ago but much lower than the £20.5bn predicted by the UK’s official forecaster.

Borrowing in the financial year from April last year to January 2025 was £118.2bn, some £11.6bn more than at the same point in the last year.

The total amount the government owes is called the national debt. It is currently about £2.8 trillion – or £2,800,000,000,000.

That is roughly the same as the value of all the goods and services produced in the UK in a year, known as the gross domestic product, or GDP.

The current level is more than double that seen from the 1980s through to the financial crisis of 2008.

The combination of the financial crash and the Covid pandemic pushed the UK’s debt up.

But, in relation to the size of the economy, UK debt figures are still low compared with much of the last century. They are also less than the equivalent figures for some other leading economies.

How much money does the government pay in interest?

The larger the national debt, the more interest the government pays.

That cost was not as great when interest rates were low during the 2010s, but became more noticeable after the Bank of England started raising interest rates in 2021.

The amount of interest the government pays on national debt also varies from month to month.

It was £8.3bn in December 2024. This was £3.8bn more than in December 2023, and is the third-highest December figure since monthly records began in January 1997.

In early January 2025, interest rates for long-term borrowing rose to their highest levels this century, before falling back.

Why does it matter if governments borrow more and spend more in interest?

If the government has to set aside more cash for paying debts, it may mean it has less to spend on public services.

Some economists fear the government is borrowing too much, at too great a cost. Others argue extra borrowing helps the economy grow faster – generating more tax in the long run.

The increase in long-term interest rates seen in January prompted some economists to warn that the government was “on course” to miss its own borrowing targets.

Labour decided to stick to a rule followed by the previous government that the total amount of money owed must have fallen as a proportion of the UK economy in five years’ time.

In October’s Budget, Chancellor Rachel Reeves changed the definition of debt that the government would use in the target to enable her to raise more money for investment.

It will now track a different, broader measure of debt called public sector net financial liabilities (PSNFL). This includes, for example, the money the government gets from people repaying their student loans.

Downing Street said there was “no doubt about the government’s commitment to economic stability”, and that “meeting our fiscal rules is non-negotiable”.

The independent Office for Budget Responsibility (OBR) – which monitors the government’s financial performance – will present its latest economic forecast to Parliament in late March.

It has previously warned that public debt could soar as the population ages and tax income falls.

In an ageing population, the proportion of people of working age drops, meaning the government takes less in tax while paying out more in pensions.

What is the difference between deficit and debt?

Debt is the total amount of money owed by the government that has built up over years.

The deficit is the gap between the government’s income and the amount it spends.

When a government spends less than its income, it has what is known as a surplus.

Debt rises when there is a deficit, and falls in those years when there is a surplus.