The US investment bank added that while store queues and resale prices have moderated, the metrics do not reflect weaker demand, as most of Pop Mart’s products were mass-market items rather than limited editions. Increasing supply through restocking “will likely lead to a sustainable balance”, it added.

Pop Mart’s extensive direct-to-consumer coverage – which accounts for 90 to 95 per cent of all sales – also gives the company access to granular, real-time data that “can effectively indicate when to reduce supply”, Morgan Stanley said.

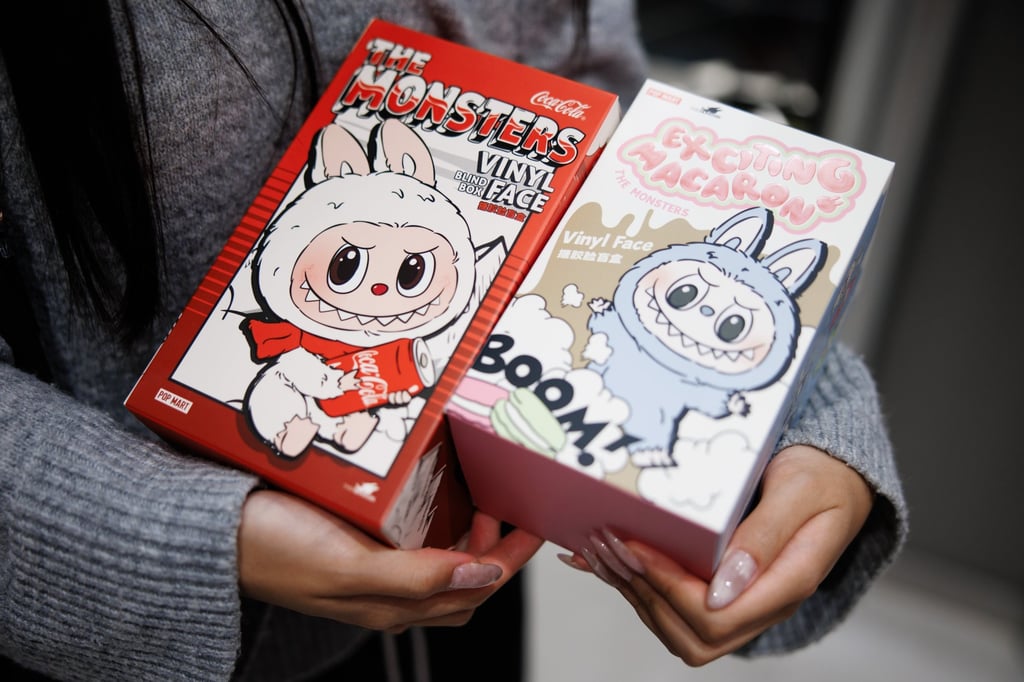

The company’s decision in June to restock some of its popular collectibles has sent resale prices plunging. Once selling for as much as tens of thousands of yuan on Xianyu, a popular Chinese second-hand online marketplace, Pop Mart’s latest iteration of its “Labubu Big Into Energy” series was now selling for an average of 150 yuan (US$21) per toy, about 50 per cent higher than its original price.

Morgan Stanley expects Pop Mart’s sales to reach US$4.3 billion in 2025 and US$6 billion in 2026, with overseas operating profit likely to account for up to 60 per cent of the total this year, “making it a true global consumer play”.