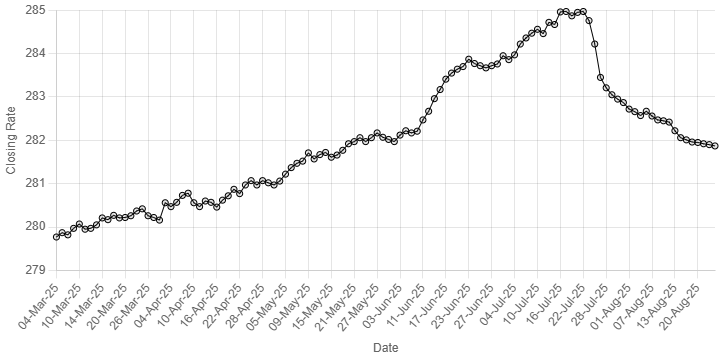

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal improvement against the US dollar, appreciating 0.01% in the inter-bank market on Monday.

At close, the rupee settled at 281.87, a gain of Re0.03 against the greenback. This was rupee’s twelfth successive gain against the greenback.

During the previous week, the Pakistan rupee recorded another positive week as it gained Re0.16 or 0.05% against the US dollar in the inter-bank market.

The local unit closed at 281.90, against 282.06 it had closed the week earlier against the greenback, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar attempted on Monday to pull itself up from a four-week low on the euro after a dovish pivot from Federal Reserve Chair Jerome Powell sent it tumbling more than 1%.

The greenback added 0.2% to $1.1699 per euro early in the Asian day, but remained not far from Friday’s low of $1.174225, a level not seen since July 28.

It rose 0.1% to $1.3502 versus sterling following a 0.8% slide in the prior session. It added 0.4% to 147.46 yen , clawing back part of Friday’s 1% tumble.

The risk-sensitive Australian dollar briefly leapt to a one-week high of $0.6523 on Monday before pulling back to trade slightly down at $0.6484. In the previous session, it surged 1.1%.

Powell, in a closely watched speech at the Fed’s annual Jackson Hole symposium on Friday, opened the door to an interest rate cut at the central bank’s September meeting.

Traders are now pricing in 80% odds of a quarter-point rate cut at the September 17 policy meeting, and a cumulative 48 basis points of reductions by year-end, according to LSEG data.

Traders had ramped up bets on a September cut early this month after an unexpectedly weak monthly payrolls report, but hotter-than-expected producer price inflation and strong business activity surveys forced a paring back in the run-up to Jackson Hole.

The dollar has been under additional pressure in recent weeks as US President Donald Trump’s attacks on Powell and other Fed policymakers raised concerns about central bank independence.

Oil prices, a key indicator of currency parity, climbed on Monday as traders weighed concerns that Russian supply could be disrupted by more U.S. sanctions and Ukrainian attacks targeting energy infrastructure in Russia.

Brent crude futures rose 40 cents, or 0.6%, to $68.13 by 1200 GMT, and West Texas Intermediate (WTI) crude futures gained 44 cents, or 0.7%, to $64.10.

Inter-bank market rates for dollar on Monday

BID Rs 281.87

OFFER Rs 282.07

Open-market movement

In the open market, the PKR gained 34 paise for buying and 10 paise for selling against USD, closing at 283.16 and 284.00, respectively.

Against Euro, the PKR lost 3.03 rupees for buying and 3.27 rupees for selling, closing at 330.49 and 332.45, respectively.

Against UAE Dirham, the PKR gained 8 paise for buying and 5 paise for selling, closing at 77.08 and 77.30, respectively.

Against Saudi Riyal, the PKR gained 9 paise for buying and 5 paise for selling, closing at 75.36 and 75.60, respectively.

Open-market rates for dollar on Monday

BID Rs 283.16

OFFER Rs 284.00