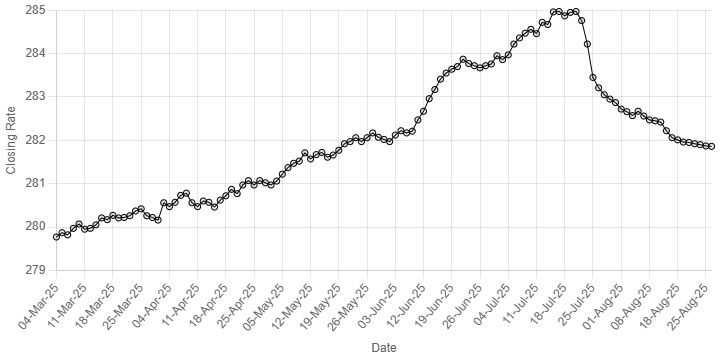

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee registered marginal improvement against the US dollar in the inter-bank market on Tuesday.

At close, the rupee settled at 281.86, a gain of Re0.01 against the greenback. This was rupee’s thirteenth successive gain against the greenback.

On Monday, the local unit closed the session at 281.87.

The rupee has maintained a positive trajectory against the greenback in recent days on account of improved sentiment in the currency market amid an ongoing crackdown by law enforcement agencies against illegal currency dealers and smugglers.

Internationally, the US dollar surrendered gains in early trading in Asia on Tuesday after US President Donald Trump said he was removing Federal Reserve Governor Lisa Cook from her position for allegedly committing mortgage fraud.

The dollar index fell 0.3% to 98.187 after Trump made the announcement in a letter to Cook that he posted on social media.

The pullback came after the US currency had registered its biggest daily gain of the month on Monday.

Trump’s unprecedented move marks a sharp escalation of the president’s battle against the Fed, which he blames for not lowering interest rates quickly, and intensifies investor worries about the US central bank’s independence.

The yield on the two-year US Treasury bond fell 3.6 basis points to 3.694% after the move, while the yield on long-dated 30-year bonds rose 3.3 basis points to 4.922%.

Against the yen, the dollar was traded at 147.18 yen , 0.4% stronger compared to late US levels.

The Australian dollar fetched $0.64915 , up 0.15% in early trade, ahead of the release of the Reserve Bank of Australia’s minutes for its August meeting. The kiwi traded 0.1% stronger at $0.5856.

Oil prices, a key indicator of currency parity, fell on Tuesday after surging nearly 2% in the previous session as traders monitor developments surrounding the war in Ukraine and potential disruption to Russian fuel supplies.

Brent crude was down 51 cents, or 0.7%, at $68.29 a barrel by 0810 GMT, having hit its highest since early August in the previous session.

West Texas Intermediate (WTI) crude lost 57 cents, or about 0.9%, to $64.23.