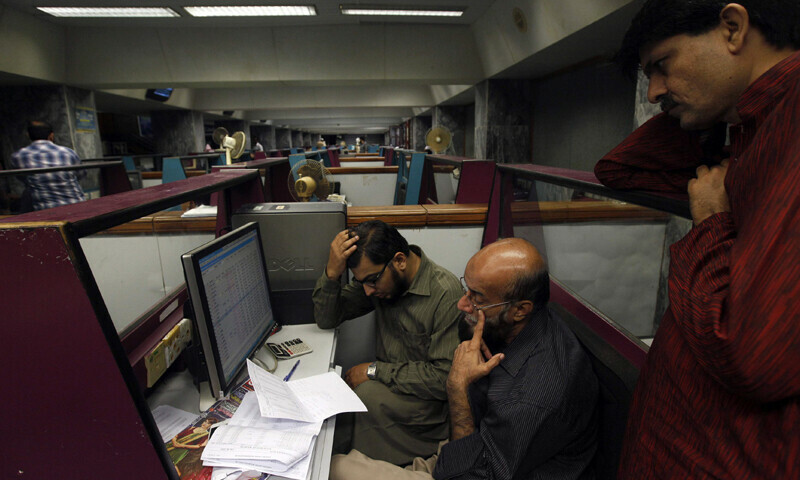

After plunging nearly 8,700 points, the largest ever intraday decline in terms of points, the benchmark KSE-100 Index recovered over 50% of its losses during trading on Monday.

Selling pressure was observed throughout the trading session as investors reacted to a global rout fueled by US President Donald Trump’s imposition of reciprocal tariffs on over 180 countries, including Pakistan.

The KSE-100 Index fell to an intra-day low of 110,103.97 by 1:10pm.

However, the stock market staged a partial recovery and by 3:30pm, the benchmark index settled at 114,909.48, still lower by 3,882.18 points or 3.27%.

During the session, following a 5% decline in the KSE-30 Index, the stock market triggered a one-hour halt from 11:58am to 12:58pm.

“All TRE Certificate Holders are hereby informed that due to a 5% decrease in the KSE-30 index from the previous trading day close of the index, a Market Halt has been triggered as per PSX Regulations and all equity and equity-based markets have been suspended accordingly.

“As a result of the halt, all outstanding orders have been cancelled automatically,” the PSX said in a statement.

Across-the-board selling pressure was observed in key sectors including, cement, commercial banks, oil and gas exploration companies, OMCs, refinery and power generation. Index-heavy stocks including HUBCO, ARL, MARI, OGDC, PPL, POL, PSO, SNGPL, SSGC, and HBL traded in the red.

The selling pressure comes on account of US President Donald Trump’s reciprocal tariffs and a decline in oil prices, Sana Tawfik, Head of Research at AHL, told Business Recorder.

“However, the selling is expected to be short-lived amid the upcoming result reason,” she said.

The selloff follows a strong week at the PSX, which had posted gains on the back of encouraging developments on the economic front.

The benchmark KSE-100 Index gained 984 points, or 0.84%, on a weekly basis, closing at 118,791 points compared to 117,807 points at the end of the previous week.

Global carnage

Internationally, major stock indexes plunged in Asia on Monday as White House officials showed no sign of backing away from their sweeping tariff plans, and investors wagered the mounting risk of recession could see US interest rates cut as early as May.

Futures markets moved swiftly to price in almost five quarter-point cuts in US rates this year, pulling Treasury yields down sharply and hampering the dollar.

The carnage came as Trump told reporters that investors would have to take their medicine and he would not do a deal with China until the US trade deficit was sorted out. Beijing declared the markets had spoken on their retaliation plans.

Investors had thought the loss of trillions of dollars in wealth and the likely body blow to the economy would make Trump reconsider his plans.

S&P 500 futures slid 3.1% in volatile trade, while Nasdaq futures dived 4.0%, adding to last week’s almost $6 trillion in market losses.

The pain likewise engulfed Europe, with EUROSTOXX 50 futures down 3.0%, while FTSE futures lost 2.7% and DAX futures 3.5%.

Japan’s Nikkei sank 6% to hit lows last seen in late 2023, while South Korea dropped 5%. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 3.6%.

Chinese blue chips lost 4.4%, as markets waited to see if Beijing would respond with more stimulus. Taiwan’s main index, which had been shut on Thursday and Friday, tumbled nearly 10% leading policymakers to curb short selling.

The gloomier outlook for global growth kept oil prices under heavy pressure, following steep losses last week.

Brent fell $1.35 to $64.23 a barrel, while U.S. crude dived $1.395 to $60.60 per barrel.

Meanwhile, the Pakistani rupee saw marginal decline against the US dollar, depreciating 0.04% in the inter-bank market on Monday. At close, the currency settled at 280.57, a loss of Re0.10 against the greenback.

Volume on the all-share index increased to 710.79 million from 553.67 million recorded in the previous close.

The value of shares rose to Rs43.02 billion from Rs35.49 billion in the previous session.

WorldCall Telecom was the volume leader with 55.27 million shares, followed by Cnergyico PK with 53.40 million shares, and B.O.PunjabXD with 34.16 million shares.

Shares of 450 companies were traded on Monday, of which 52 registered an increase, 357 recorded a fall, while 41 remained unchanged.