Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to get the newsletter delivered every weekday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters

Good morning. Somewhere behind the Trump tariff story, the AI story is still running. Microsoft reported 20 per cent growth in its Azure business, driven by AI services demand. Both Microsoft and Meta confirmed their intention to continue investing extravagantly on data centres. Maybe we could focus on that, rather than the White House, for a couple of days? Email us: robert.armstrong@ft.com and aiden.reiter@ft.com.

GDP: before and after

Most of our measures of the US economy are like the “before” half of one of those “before and after” advertisements for de-ageing cream, liposuction, or dandruff shampoo. What we really want is the “after” picture, but it’s not yet available. So we have to make do with careful study of the “before” picture and some educated guesses about the effects of the miracle treatment.

The treatment, of course, is Donald Trump’s ultra-high tariff regime, which was rolled out on April 2, right at the start of the second quarter. So that day casts a shadow over the first quarter advance GDP report, which landed yesterday.

But the report was a pleasant surprise. The “before” picture looks pretty good.

Yes, headline growth was negative 0.3 per cent — but that number is an artefact of a massive surge in imports, which dragged down the headline growth number by up to 4.8 per cent. Imports are subtracted from GDP because they are not produced in the country (not “domestic product”) and to avoid double counting them in consumption and investment. If the Q1 surge in imports was truly demand pulled ahead, this should be a distortion that will wash out over time.

We will return to the meaning of the import explosion in a moment. Look first at the strong aspects of the report. Real household consumption, the main engine of the US economy, grew by 1.8 per cent, and real final sales to domestic purchasers, which is consumer spending plus fixed private investment excluding inventories, rose 3 per cent. Given wretched consumer and small business sentiment surveys of recent months, this is a real relief.

But on the investment side of things, the numbers get a bit trickier to interpret. Private investment grew at a stonking 22 per cent annualised rate from the previous quarter. Almost all of that was down to a huge jump in purchases of computer equipment which by themselves contributed almost a full percentage point to GDP. It seems very likely that a good deal of this was due to companies rushing to fill long-term needs from global suppliers ahead of tariffs. But how much? And how much is continued strong demand from the AI economy? We don’t know, and the answer makes a big difference to our reading of how strong the economy really is.

There was evidence of tariff fears pulling demand forward elsewhere in the report. Again, however, interpreting the numbers is tricky. A huge build-up in business inventories contributed over 2 percentage points of growth to GDP. But in a footnote, the Bureau of Economic Analysis says: “The estimates of private inventory investment were based primarily on Census Bureau inventory book value data and a BEA adjustment in March to account for a notable increase in imports.” Our colleague Chris Giles translated that for us: there is hard data on the surge in imports, which can be counted as they come through ports. The inventory numbers, by contrast, are mostly the product of models and estimates which use the import surge as an input. It may be that the consumption is significantly higher than these numbers indicate, and the inventory build lower, or vice versa, and the difference matters to our assessment of growth.

A final crucial aspect of the report: inflation. Core personal consumption expenditures price inflation, the Federal Reserve’s preferred measure of inflation, came down a little monthly and annually, but is still above target at a 2.6 per cent annual rate.

Summary: consumption growth is holding up nicely, though not accelerating; business investment looks good too, but the tariff effect clouds that picture; and inflation is falling but isn’t quite where it needs to be. To us, that looks like a formula for the Fed leaving rates where they are at next week’s meeting and possibly longer (the futures market implies four 25 basis point rate cuts by the end of the year; there are six meetings left).

A nice “before” picture, then. What if anything can we say about the “after”?

We have good reason to think that the consumer has continued to chug along nicely since April 2. On Tuesday, Visa reported that payment volumes across its US network grew 6 per cent in the first quarter, in line with the results of recent quarters, and volumes actually picked up a bit in the first three weeks of April. Here is the CEO:

We have not seen any signs of overall consumer spending weakening. While spending growth differs among consumer spend bands, with the most affluent growing the fastest, all spend bands remain resilient and consistent with past quarters. Within spend categories, there are some select areas such as in travel with airlines and lodging where growth has decelerated, but overall discretionary and non-discretionary spend remains strong.

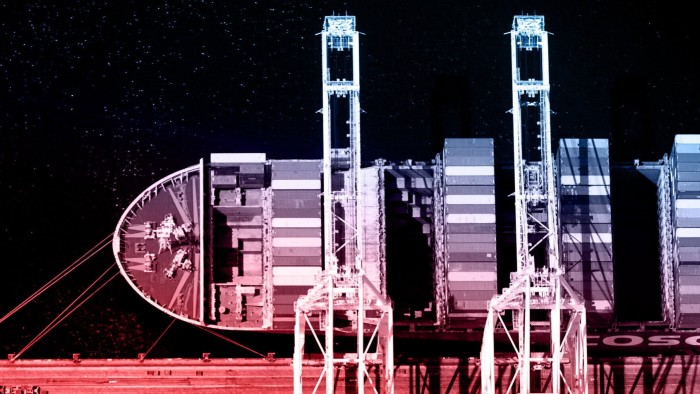

But consumers have not felt the effect of tariffs yet, either in higher prices or in unavailable products. And few businesses have yet had to make hard choices about whether to absorb tariff costs, pass them on to customers, or simply cease importing certain products. Most will still have pre-tariff inventory to burn through while they pray for a policy change. But the moment of truth is approaching at the deliberate speed of a cargo ship. From the FT on Sunday:

The Port of Los Angeles, the main route of entry for goods from China, expects scheduled arrivals in the week starting May 4 to be a third lower than a year before, while airfreight handlers have also reported sharp falls in bookings.

Bookings for standard 20-foot shipping containers from China to the US were 45 per cent lower than a year earlier by mid-April, according to the latest available data from container tracking service Vizion.

Barring a prompt and meaningful tariff climbdown, the “after” picture will be fully developed by sometime this summer.

One good read

Logos matter.

If you are interested in more of our thoughts about markets, tariffs, and the economy, Unhedged and our colleagues chatted about the outlook at an FTLive event last week. A video is available here.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.

Recommended newsletters for you

Due Diligence — Top stories from the world of corporate finance. Sign up here

Free Lunch — Your guide to the global economic policy debate. Sign up here