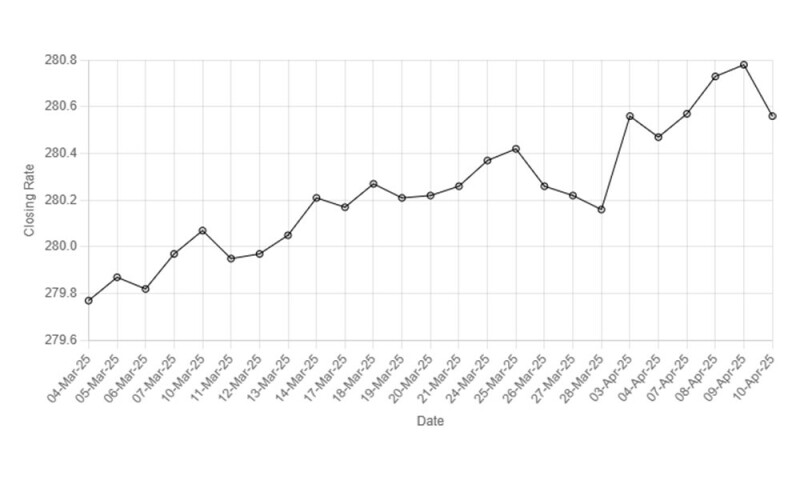

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee saw slight improvement against the US dollar, appreciating 0.08% in the inter-bank market on Thursday.

At close, the currency settled at 280.56, a gain of Re0.22 against the US dollar.

On Wednesday, the currency settled at 280.78.

Internationally, traders swept back into safe havens like the yen and Swiss franc and sold the Australian dollar on Thursday, after US President Donald Trump ramped up his trade war against China even as he abruptly paused tariffs for 90 days on many other nations.

The US dollar dropped 0.7% to 146.68 yen as of 0100 GMT, It similarly fell 0.62% to 0.8522 Swiss franc.

Risk-sensitive currencies surged overnight, with the yen and Swiss franc tumbling following Trump’s unexpected respite from the hefty reciprocal duties levied in his “Liberation Day” announcement from a week ago, which triggered historic stock and bond routs.

The uptick in safe-haven currencies came even with Asian stock markets surging, as they joined the global relief rally.

Trump maintained a baseline tariff rate of 10% while ratcheting up his trade war with China by further raising the tariff rate to 125% on goods from the world’s second-biggest economy.

That tempered some of the cheer from the overnight pause on tariffs, as markets fretted about the longer-term impact on growth and how Trump’s economic policies will play out during his term.

The Chinese yuan weakened slightly in offshore trading, after a more-than 1% round-trip in the past two days to an all-time low and back again.

US Treasury Secretary Scott Bessent asserted on Wednesday that the sweeping tariff pullback had been the plan all along to bring countries to the bargaining table. Trump, though, later indicated that the near-panic in markets that had unfolded since his April 2 announcements had factored into his thinking.

Oil prices, a key indicator of currency parity, retreated on Thursday as U.S. President Donald Trump ramped up a trade war with China, even as he announced a 90-day pause on tariffs aimed at other countries.

Brent futures fell 77 cents, or 1.18%, to $64.71 a barrel by 0320 GMT, while U.S. West Texas Intermediate crude futures fell 65 cents, or 1.04%, to $61.70.

Following the tariff pause for most countries, the benchmark crude contracts had settled 4% higher on Wednesday after dropping as much as 7% during the session.