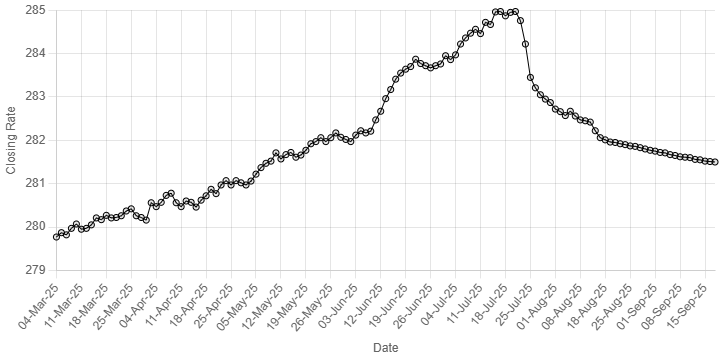

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee maintained its positive momentum against the US dollar, appreciating marginally in the inter-bank market on Wednesday.

At close, the rupee settled at 281.50, a gain of Re0.01 against the greenback. This was the rupee’s 29th consecutive gain against the greenback.

On Tuesday, the local unit closed at 281.51.

Internationally, the US dollar was on the defensive, shares edged lower, and gold scaled new heights on Wednesday as global markets counted down to an anticipated rate cut by the Federal Reserve later in the day and waited on signals around the extent of future easing.

The euro surged to a four-year high against the greenback in the prior session on the Fed easing bets, while oil remained firm following Ukrainian drone attacks on Russian refineries and ports.

The Fed is expected to cut its benchmark interest rate by a quarter of a percentage point to the 4.00%-4.25% range at the end of its monetary policy meeting later in the day. The main focus beyond the rate decision will be on Chair Jerome Powell’s comments on the outlook for US monetary policy.

The dollar index, which tracks the greenback against a basket of currencies of other major trading partners, edged up 0.1% to 96.689 after a 0.7% slide on Tuesday to the lowest since early July.

The European single currency was down 0.1% at $1.1857, after touching $1.1867 on Tuesday, its highest level since September 2021.

The US dollar was little changed at 146.52 yen following a 0.6% slide in the previous session.

Oil prices, a key indicator of currency parity, eased on Wednesday, after rising more than 1% in the previous session, though ongoing geopolitical jitters provided a floor for the market, with traders eyeing an expected interest rate cut from the US Federal Reserve later in the day.

Brent crude futures were down 33 cents, or 0.5%, to $68.14 a barrel at 0810 GMT, while US West Texas Intermediate crude futures were down 32 cents, or 0.5%, to $64.20 a barrel.

The benchmarks settled more than 1% higher in the last trading session due to concerns that Russian supplies may be disrupted by Ukrainian attacks.