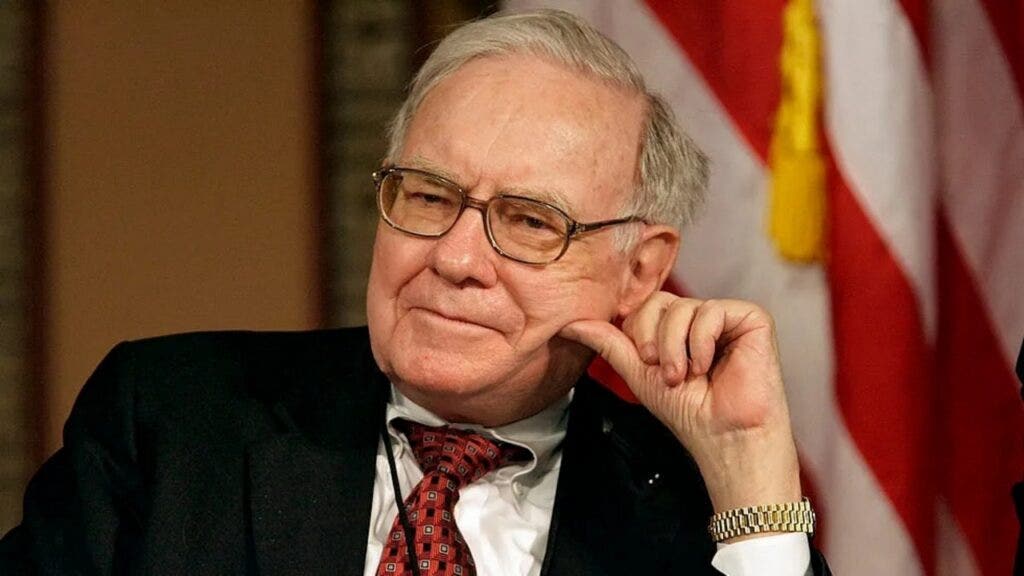

Warren Buffett has made plenty of winning moves, but he’s just as quick to call out his missteps. One of his biggest? Wasting years chasing dirt-cheap stocks that weren’t actually worth owning.

For a long time, Buffett followed the “cigar butt” strategy—buying stocks that were cheap simply because they were cheap. As he explained in a 2001 speech at the University of Georgia:

“You walk down the street and you’re looking around for cigar butts, and you find on the street this terrible-looking, soggy, ugly-looking cigar—one puff left in it. But you pick it up and you get your one puff. Disgusting, you throw it away, but it’s free. I mean it’s cheap. And then you look around for another soggy one-puff cigarette.”

That was his investing mindset for years. And sure, you can make some money doing it. But as Buffett put it, “It’s so much easier just to buy wonderful businesses.”

Don’t Miss:

One of Buffett’s worst purchases was Berkshire Hathaway (NYSE:BRK, BRK.B)) itself. In the early days, it was nothing more than a struggling textile business that happened to be trading below its working capital per share.

He explained: “You got the plants for nothing, you got the machinery for nothing, you got the inventory and receivables at a discount. It was cheap, so I bought it.”

Sounds like a steal, right? Except 20 years later, he was still stuck running a bad business that wasn’t compounding his money.

Trending: Deloitte’s fastest-growing software company partners with Amazon, Walmart & Target – Many are rushing to grab 4,000 of its pre-IPO shares for just $0.26/share!

Buffett continued, “Time is the friend of the wonderful business. You keep compounding, it keeps doing more business, and you keep making more money. Time is the enemy of the lousy business.”

That’s the real issue with bad businesses. Even if you get them at a bargain, they don’t grow into anything valuable.

Buffett eventually abandoned his bargain-hunting obsession and started focusing on quality. Instead of buying stocks just because they were cheap, he looked for companies with strong fundamentals—businesses that could grow and multiply his investment over time.

Story Continues