(Bloomberg) — The European Central Bank lowered interest rates for the sixth time since June and indicated that its cutting phase may be drawing to a close as inflation cools and the economy digests seismic shifts in geopolitics.

Most Read from Bloomberg

The deposit rate was reduced by a quarter point to 2.5%, as predicted by all but one analyst in a Bloomberg survey. Officials described their monetary-policy stance as becoming “meaningfully less restrictive.”

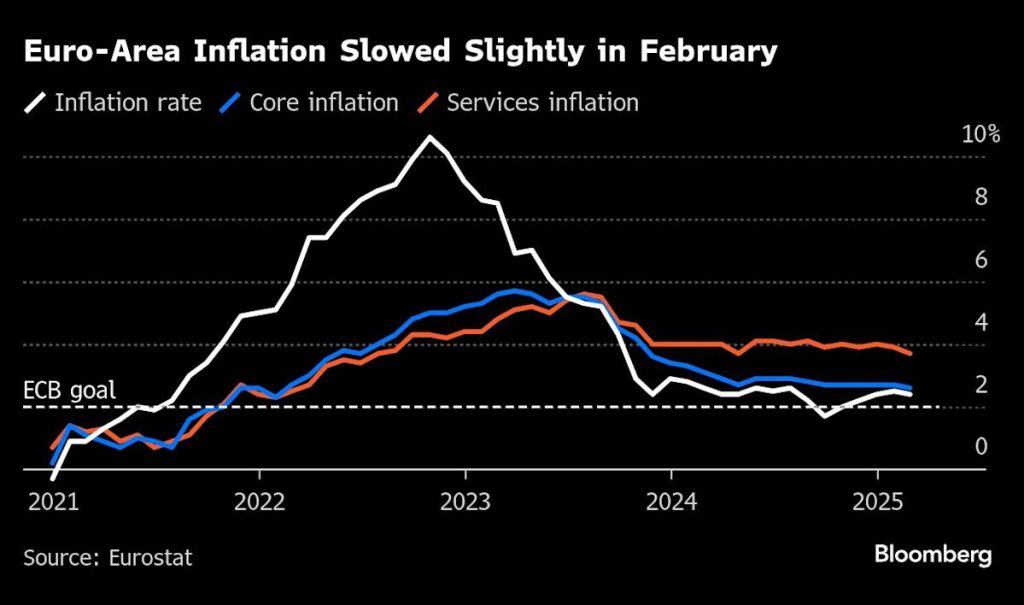

Revealing that inflation will take slightly longer to reach 2%, the ECB is switching “to a more evolutionary approach,” President Christine Lagarde said Thursday. She repeated that policymakers won’t commit to any particular path for borrowing costs, since the backdrop is changing “dramatically” from one day to another.

“We will all have to be extremely vigilant — we will have to be agile, to respond to the data,” Lagarde told reporters in Frankfurt. “If the data indicate that the most appropriate monetary-policy stance is a cut, it will be a cut. If, on the other hand, the data indicate that the most appropriate decision is not to cut, then it will be a pause.”

Changing its statement language will feed speculation that the ECB is contemplating a timeout from rate cuts next month, confident that its inflation goal is within reach. That may be bad news for Europe’s stuttering economy, which as well as US trade tariffs must now also deal with a glut of spending to retool the continent’s armies.

“The disinflation process is well on track,” the ECB reiterated. Lagarde said it will now meet its goal very early in 2026, rather than this year as envisaged before.

The euro extended gains to hit the day’s high while bonds fell following the ECB’s statement. The yield on 10-year German notes was up five basis points to 2.84%, while traders pared wagers on further easing to bet on just 43 basis points more by year-end.

“With the increased uncertainty and the prospects of large fiscal stimulus, the ECB’s direction of travel after today’s rate cut is no longer as clear as it was a few weeks ago,” Carsten Brzeski, ING’s global head of macro, said by email. “A pause at the next meeting to come to terms with the new macro reality now looks like a possibility.”

Updated quarterly projections largely confirmed the ECB’s outlook for prices, while lowering it for growth this year and next. But they don’t capture the consequences of President Donald Trump’s abrupt pullback in military backing for Ukraine and Europe.

Story Continues