(Bloomberg) — The silver market faces mounting stress as trade-war concerns intensify, with higher rates to borrow metal adding to signs of global dislocation.

Most Read from Bloomberg

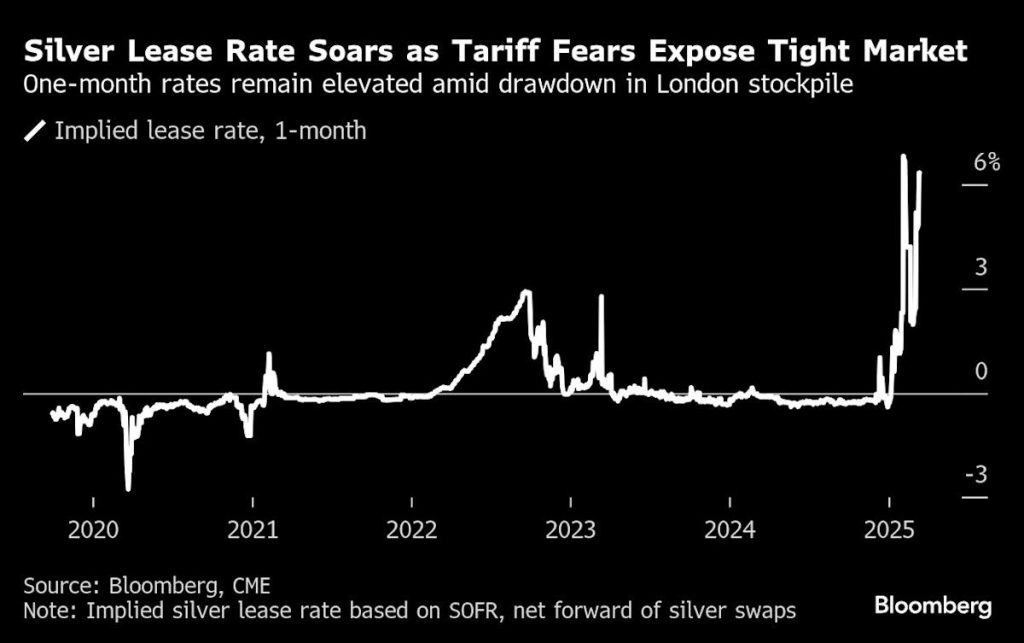

A surge in lease rates for the precious metal has become the latest sign of alarm, with anxiety building over the impact of further tariffs from US President Donald Trump. That’s sparked a dash to ship silver into the US in a bid to capture premium prices in New York, possibly causing a squeeze in London.

Precious metals — gold as well as silver — have been upended this year, as Trump challenges the global trade order. That’s spurred demand for havens, and also opened up rare pricing dislocations between key markets. While spot silver has gained about 17% this year — making it one of the best performing commodities — futures in New York have done even better.

On a physical level, the tariff concerns — especially levies against Canada and Mexico, as well as wider reciprocal curbs that may kick in next month — have drawn vast quantities of both gold and silver out of London into US vaults. But given their relative value and density, gold tends to be air-freighted, with silver often taking far longer voyages, typically by ship.

Lease rates — the cost of borrowing metal, generally for a short period — have jumped. One-month rates for silver topped 6% this month after a larger spike in February. That partly reflects concerns about fast-depleting stockpiles in the UK capital, with holdings hitting a record low last month. In addition, not all of what remains is available given it’s tied to exchange-traded products.

“I expect the lease rate in London to remain high for about two to three months,” said Cao Shanshan, an analyst at COFCO Futures Co. With the UK-to-US transfer under way, “silver is a lot bulkier than gold, so the transfer of silver will likely take longer,” she said.

Exchange-reported totals in the US reflect the turmoil. Comex-tallied inventories of silver have expanded to the highest level ever in data going back to 1992 after surging by 40% so far this quarter, a record rise. While New York is still drawing in metal at present, there are also concerns the flows may be thrown into a drawn-out reverse if silver faces a shortage in London vaults.

“Should the long-fabled ‘silver squeeze’ materialize, this slower tradeflow will be a key contributor to prolonging” any potential disruption BMO Capital Markets analyst George Heppel said in a note. That’s because it would take time for silver stockpiles to flow from the US back to London, he said.

Story Continues