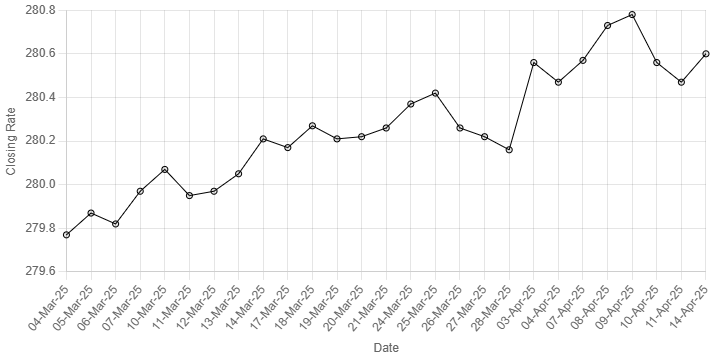

Rupee’s Performance Against US Dollar Since 04 March 2025

The Pakistani rupee saw slight decline against the US dollar, depreciating 0.05% in the inter-bank market on Monday.

At close, the currency settled at 280.60, a loss of Re0.13 against the US dollar.

During the previous week, the Pakistani rupee remained stable against the US dollar in the inter-bank market.

The rupee lost Re0.31 in the first three sessions of the week, but gained momentum to appreciate by the same in the last two sessions.

Resultantly, the local unit closed at Rs280.47, unchanged from the rate against the greenback it had closed at during the week earlier, according to the State Bank of Pakistan (SBP).

Internationally, the US dollar drifted lower on Monday as an early bump off a three-year low fizzled, with markets spooked by the stream of tariff-related pronouncements from US President Donald Trump that last week shook investor confidence in the world’s reserve currency.

Investors braced for another volatile week as Trump’s imposition and then abrupt postponement of tariffs on goods imported to the US continued to sow confusion.

The dollar reversed early gains as the Asian trading session got under way, falling against the Swiss franc towards a 10-year trough hit on Friday.

The dollar last traded 0.05% lower against the Swiss franc at 0.8158.

Against the yen, the dollar fell 0.62% to 142.62.

Oil prices, a key indicator of currency parity, edged up on Monday after Chinese data showed a sharp rebound in crude imports in March, although concerns that the escalating trade war between the United States and China would weaken global economic growth and dent fuel demand weighed.

Brent crude futures gained 6 cents, or 0.09%, to $64.82 a barrel at 0632 GMT.

US West Texas Intermediate crude futures were trading at $61.59 a barrel, up 9 cents, or 0.15%.